Buy Home Insurance Online:- When purchasing home insurance, the last thing you want to be distracted by an irrelevant website and miss out on a great offer. That is why so many home insurers now provide their services online.

While buying home insurance online may make life simpler, its implications remain more complex than just making an online transaction.

No matter which method you use for payment, all that really changes is how your personal information is stored and utilized. Here are some tips for purchasing home insurance online safely and efficiently:

Buy Home Insurance Online

1) Be Wary Of Free Trials

When shopping online for home insurance policies, there will likely be various payment options presented to you. Most will involve monthly payments; others might provide one-off payments or free trials that tempt buyers. In your rush to purchase online home policies quickly, free trials could tempt you.

Feeling lucky? Trying a free trial might make you think so, with no upfront payment and only payment due once you decide to keep the policy in force. But be wary: without realizing it, this may lock you into a long-term policy commitment without realizing it!

Free trials typically last 30 or 60 days, after which time it becomes much harder to cancel the policy. Therefore, buy the policy you desire with an agreement that best suits your long-term needs in mind and save yourself the hassle of trying to back out later.

2) Check Your Credit Score

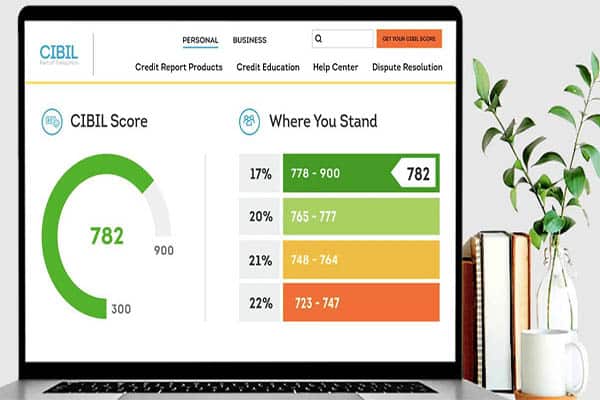

Home insurance providers always review your credit score before offering you a policy, as it serves as an indication of the risk you pose to their business. If your score falls below certain thresholds, premiums could become much more costly compared with those who have better scores.

When purchasing home insurance online, this check will likely occur automatically and should be factored into your purchasing deadline. If your credit score is low, there are a few steps you can take to boost it; paying off credit cards or debt should be top of mind; having said that, having a higher mortgage won’t negatively impact it; yet paying it off as soon as possible should still be prioritized.

3) Be Careful With Your Personal Information

When purchasing home insurance online, you are entering into a transaction with someone completely unfamiliar. While they may request your address or financial data for their quote purposes, be wary about entering it all just yet without taking precautions such as: – Avoid public computers

Use a Virtual Private Network (VPN). Access public wifi hotspots. Use a burner phone – for added protection use one with pre-paid service if possible (this may not apply to everyone, however prepaid phone plans could be beneficial in high-profile industries where privacy is key), as you can purchase them almost anywhere and then dispose of them after use.

4) Ask For Recommendations

If you’re purchasing home insurance online, it can be useful to talk with friends and family members who have had previous experiences. If they had a positive one, chances are high you will too; conversely if there was anything negative then keep that in mind and try not to repeat their mistakes.

As it’s unlikely you’ll come across many people with excellent experiences with all home insurance providers, enlisting the assistance of some trustworthy individuals is the key to making informed decisions when selecting your provider. When gathering recommendations, be sure to find out why these people recommend the provider; inquire as to what they like or dislike about it; ask for suggestions of future providers; find out why these recommendations were given; gather more information from them regarding why they recommend this provider; learn what changes would they like implemented next time and more importantly gather any advice they’d make changes; with all this knowledge you will be much closer towards making informed decisions regarding which provider will work best.

5) Check The Small Print

Before purchasing home insurance online or in person, it’s vital that you read through every fine detail carefully. There are several key things you should check for: for instance, make sure your policy does not have a no-claims bonus reduction clause after some time has passed and check that no policy terms such as no claims bonus reduction clause exist after having owned it for an extended period.

If this is the case, then over time your premium may increase over time as well as over years of uninterrupted coverage. Furthermore, check that your policy includes a non-consequential clause; this ensures any damages or losses covered under your coverage are taken into account and only pay out what difference exists between what the provider paid out and what your liability payments owe are taken into consideration.

Also Refer:- Best 5 Importance of Life Insurance To During a Recession

Conclusion

Home insurance is an essential way of protecting what is likely your most valued possession – yet buying it online can often be confusing and daunting. By following these tips, however, purchasing home insurance with confidence should become a reality.